[ad_1]

Header Picture Supply: Pexels

Making certain that everybody at your organization will get paid precisely and on time is important. Doing so impacts your staff’s motivation, their notion of your organization, and your authorized compliance. Nonetheless, handbook payroll administration, both on-house or with an exterior service supplier, will be time-consuming and error-prone, inflicting bottlenecks and delays in payroll operations.

The answer? Streamline your payroll operations by utilizing superior payroll instruments. When you’re on the lookout for the perfect instruments for issuing payslips and worker wage funds routinely, you’ve come to the correct place.

It’s vital to contemplate instruments with particular functionalities tailor-made to the intricacies of the UK tax and employment panorama, which can assist guarantee compliance with employment legal guidelines. A software that takes UK payroll’s distinctive challenges under consideration is the final HR ally, and the 5 options beneath all qualify on this regard.

A fast overview of payroll instruments for the UK

Payroll instruments are highly effective software program options that automate and streamline the payroll course of. Payroll options designed to deal with UK payroll rules can take care of tax necessities and employment legal guidelines, making certain correct and compliant worker cost processes.

These instruments usually supply functionalities that simplify payroll administration duties, together with automated era of payslips, calculation of tax deductions, Nationwide Insurance coverage contributions, and statutory funds resembling sick depart and maternity pay.

Most can combine with His Majesty’s Income and Customs (HMRC) programs, permitting companies to submit common experiences and keep up to date with the most recent tax rules and reporting necessities. Apart from simplifying payroll calculations, payroll instruments can present options for managing office pensions, producing year-end experiences resembling P60s and P11Ds, and facilitating communication with pension suppliers.

Discovering the perfect payroll software can take time and analysis, however we can assist slim your search with the 5 instruments to hurry up your payslip era and funds beneath.

1. Pento

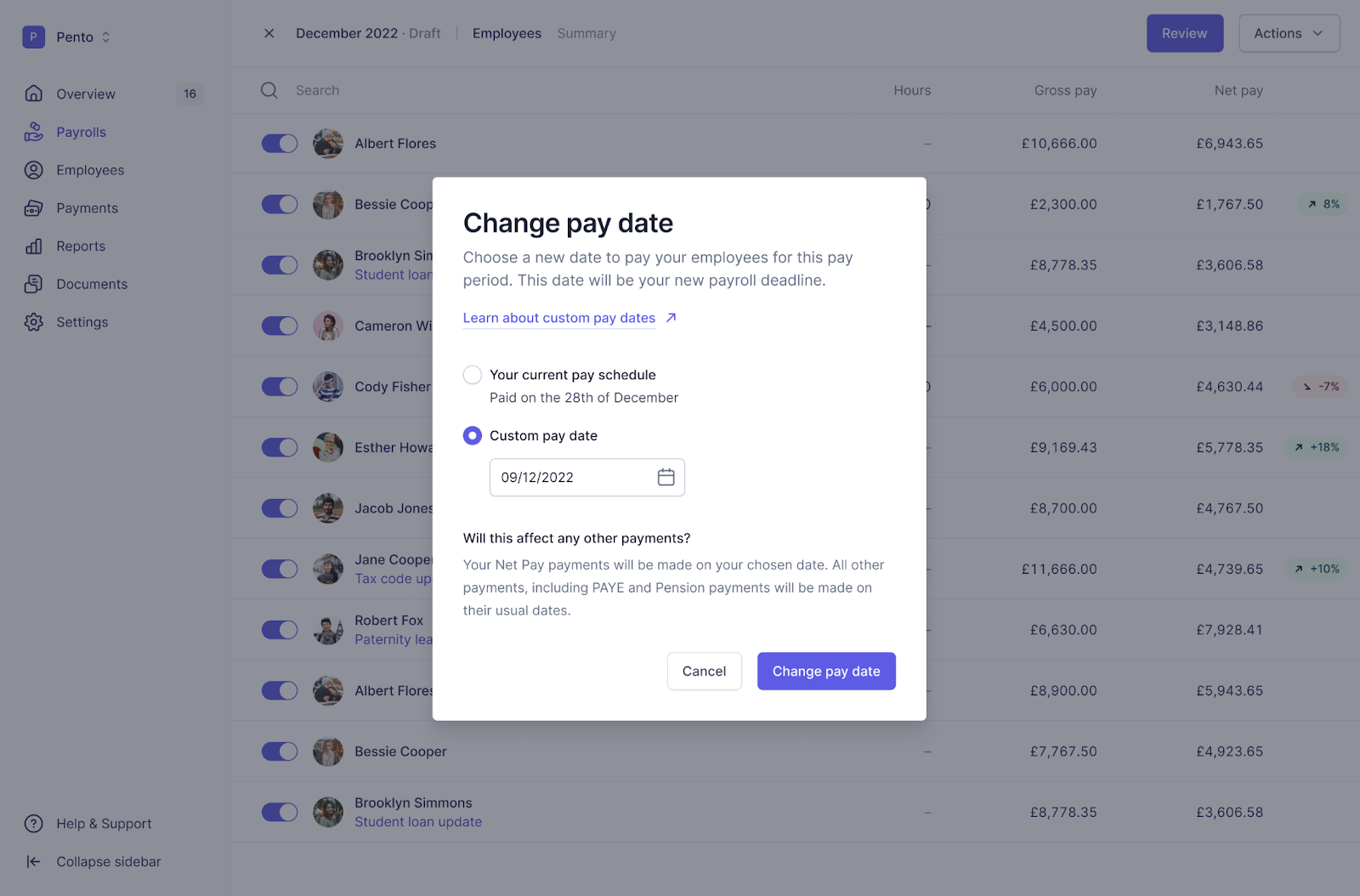

Efficient payroll administration includes many transferring components which might be time-consuming, resource-draining, and difficult to handle with out the correct software. One of many main payroll instruments that may aid you overcome these challenges is Pento.

Pento is a feature-packed software program platform with automated payroll instruments. It will probably routinely make financial institution funds, calculate taxes, sync with HMRC and pension suppliers, and auto-enrol eligible staff members for respective pensions.

It additionally syncs info together with your different HR programs, resembling CharlieHR, BambooHR, and Hibob, so you’ll be able to minimise information entry and compliance points by auto-updating worker particulars after which routinely making funds to HMRC’s PAYE system on time.

With its easy-to-use interface and instruments, you’ll be able to distribute paycheques and switch cash, generate experiences to trace modifications and developments, and simply regulate worker salaries and particulars each time you might want to, proper till the second whenever you shut payroll.

The payroll answer has a devoted onboarding staff that can assist you get began, and it presents continued help throughout a number of channels, together with e mail, chat, and telephone. Whereas Pento does combine with accounting instruments, the platform itself is just for payroll, so in case you’re on the lookout for a complete finance suite, this isn’t the choice for you.

Pento’s pricing begins at £5 per worker monthly, with a minimal month-to-month price of £149, and you may attain out to study extra or get a extra customized quote.

2. Xero

Xero is an accounting tech answer designed for small and medium-sized companies. The software program supplies accounting and monetary administration instruments to assist streamline your small business processes, handle funds, and collaborate with accountants or bookkeepers.

Xero’s essential options and functionalities embrace the next:

- Payroll administration that can assist you oversee worker wages, taxes, and compliance necessities.

- Invoicing and billing instruments to create skilled invoices and observe funds. Xero additionally helps automated bill reminders and recurring invoicing.

- Financial institution reconciliation choices that join your financial institution accounts to Xero, routinely importing and categorising your transactions for sooner and extra correct reconciliation.

- Reporting and analytics instruments that can assist you generate monetary experiences, observe key efficiency indicators, and achieve insights into your small business’s efficiency.

- Integrations with many third-party functions, resembling cost gateways, ecommerce platforms, and buyer relationship administration (CRM) programs.

Whereas Xero presents payroll administration instruments, the answer could also be overkill in case you’re all set with a bookkeeping and invoicing answer and all you want is a dependable payroll software.

Xero has a steep studying curve, and a few say that it isn’t very best for newbies and busy groups.

Xero’s pricing plans begin at £14 monthly, with a 50% low cost accessible for the primary six months, with relevant phrases.

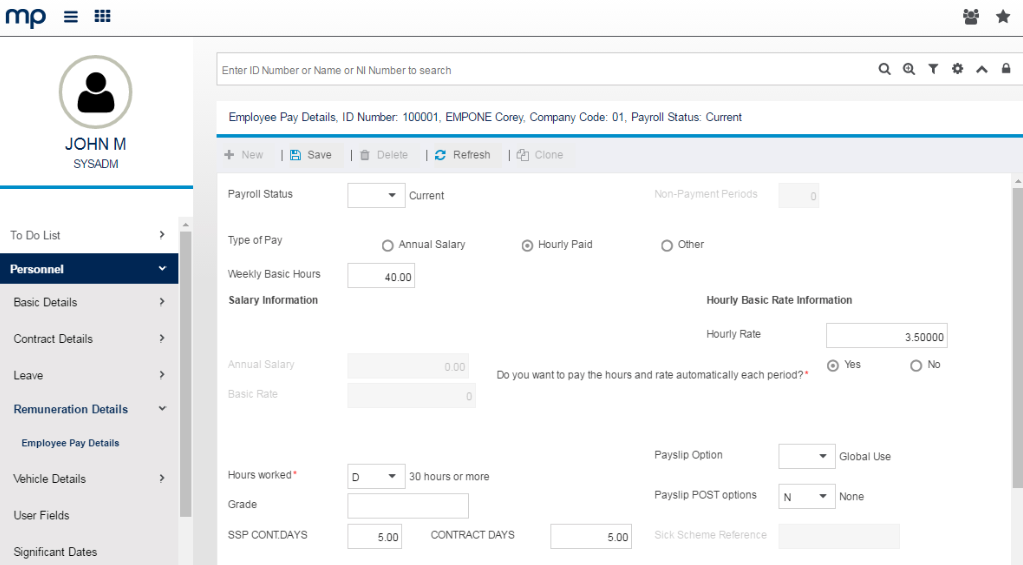

3. Moorepay

Moorepay is a hybrid answer that mixes payroll instruments, different HR options, in addition to done- for-you providers. It presents options that can assist you handle your payroll processes, adjust to employment rules, and streamline HR workflows and duties.

You may select from these Moorepay payroll choices:

- Payroll software program with automated pay, tax, and deduction, together with OSP, SSP, SMP calculations, payslip era, and full integration choices with Moorepay’s HR software program.

- Payroll outsourcing by getting into your information into Moorepay’s payroll software program, and its staff of consultants deal with the remainder, from producing correct payslips to creating well timed HMRC funds.

Whereas Moorepay is nice if you would like a hybrid answer, it might contain the standard points when outsourcing payroll, resembling inefficiencies because of lengthy again and forths together with your supplier. And given how simple at the moment’s superior instruments are to handle, many corporations that used to make use of payroll bureau providers have began “insourcing” as a substitute.

Moorepay’s pricing isn’t as clear-cut as different payroll options, for the reason that firm appears to emphasize its full-service observe and subsequently doesn’t present a single worth level or generic package deal choice. It’s essential to reply a questionnaire from the Moorepay staff, who then recommends a worth level and repair package deal in your approval.

4. Octopaye Payroll

Octopaye is a cloud-based payroll platform that provides a number of payroll fashions, resembling umbrella PAYE, joint employment, a number of corporations, and PEO/payroll bureau. This service supplier and its platform is designed to run payroll for corporations and recruitment businesses with many staff and often handles irregular cost patterns.

The software program can run 1000’s of simultaneous funds (and cost fashions) and handle a number of processes all through numerous corporations in a single administration portal. It will probably calculate and course of inner cost administration and PAYE providers.

Octopaye allows you to tailor your entry and dashboard to satisfy and deploy a number of payroll fashions effectively. It will probably combine with third-party programs, resembling doc administration, banking, compliance, and pension suppliers, to streamline payroll administration. You can too rebrand your payslips and portals together with your firm colors and brand and entry detailed experiences.

Like most outsourced payroll providers, versus pure software program performs, some could discover it difficult to have full management over payroll administration with Octopaye.

It is advisable to contact Octopaye to obtain customized pricing info.

5. PrimePay

PrimePay is an all-in-one payroll and HR platform that simplifies administration throughout the worker cycle, from hiring to retiring. The software program can automate and combine important providers and processes, together with advantages, onboarding, and insurance coverage disbursements.

PrimePay’s answer contains:

- HR administration

- Self-service and done-for-you payroll

- Advantages administration

- Finance analytics

- Time and labour administration

- Insurance coverage and compliance

One draw back to PrimePay is that it might take too lengthy to finish and make experiences accessible, slowing down your accounting processes. Some experiences are additionally difficult to seek out and pull with out help, and you could possibly wait days earlier than understanding if an worker hasn’t been paid. PrimePay additionally doesn’t supply weekend or nighttime help.

PrimePay pricing begins at beneath £50 monthly.

Discover the perfect payroll software for you

Leverage the facility of automated payroll instruments to streamline your complete strategy of producing payslips and be certain that your staff will get paid on time, each time.

These instruments prevent valuable effort and time whereas decreasing errors and compliance points. Embracing payroll automation will undoubtedly revolutionise the way you deal with your payroll duties. Spend money on the correct payroll software at the moment and unlock a seamless, hassle-free payroll expertise in your firm.

[ad_2]

Source link