[ad_1]

Olivier Le Moal

Oxford Industries (NYSE:OXM) is at the moment undervalued based mostly on my discounted money circulation evaluation and is powerful relative to friends on a number of metrics presently. Nevertheless, I’ve issues about its long-term development prospects elucidated by traits in shifts in financial class within the US, OXM’s major market. My evaluation reveals there may be nonetheless a compelling shopping for alternative right here regardless of dangers associated to this and appreciable liquidity weak point in the mean time.

Operations & Market Tendencies

The corporate is internationally famend as an attire design, sourcing, and advertising firm that owns a portfolio of profitable manufacturers. These embrace Tommy Bahama, Lilly Pulitzer, and Southern Tide. Its operations embrace retail shops, e-commerce, and wholesale.

Tommy Bahama focuses on island-inspired sportswear and equipment, Lilly Pulitzer provides clothes and equipment interesting to ladies, and Southern Tide has a concentrate on the Southern life-style with informal and traditional types. Oxford Industries has a worldwide community of suppliers and producers to supply merchandise throughout its vary of manufacturers.

OXM Manufacturers (OXM December 2023 Presentation)

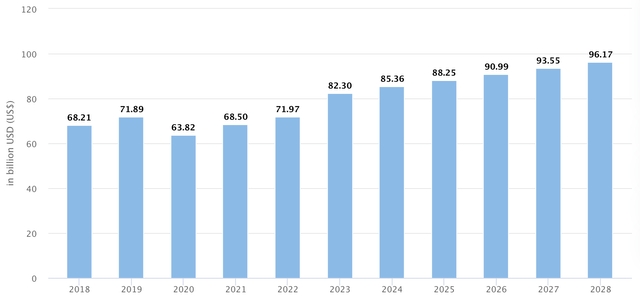

In keeping with McKinsey’s “The State of Vogue 2024” report, the style trade worldwide is ready to see top-line development of round 3% this yr. The luxurious section is forecasted to develop at round 4% globally; non-luxury segments within the US are anticipated to develop at round 1% as a result of difficult financial setting at current.

Vogue market dynamics are shifting as they’re being influenced by digital advertising traits, demand for personalization, and competitors from smaller, extra native manufacturers providing aggressive pricing. Dominant friends in luxurious, together with PVH Corp. (PVH), Kering SA (OTCPK:PPRUF) & LVMH (OTCPK:LVMHF), will likely be tailoring their methods to those new expectations, however Oxford Industries might have a more durable time maintaining with the costly transitions taking place in bigger conglomerates. OXM’s goal market is extra the center class, and as mentioned previous to my valuation commentary under, OXM might must shift its goal market extra towards its bigger luxurious friends to keep up development.

Luxurious Attire – Worldwide Income (Statista)

Financials

From my evaluation of Oxford Industries’ financials, it seems to be significantly well-positioned and aggressive, opening up a big funding alternative, in my view.

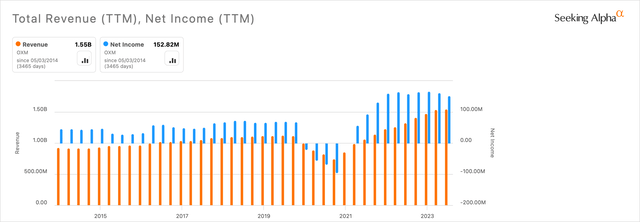

Writer, Utilizing Searching for Alpha

The agency’s YoY income development is 16.6%, which is 263.42% increased than the sector median of 4.57%. Over the previous 5 years, OXM has had a median income development charge of seven.96%. Its ahead EPS GAAP development is 10.03%, 200.04% increased than the sector median of three.34%.

One notable weak point financially is a low ahead free money circulation per share development charge of -5.09% in comparison with the sector median of 4.79%. Nevertheless, it have to be famous that its five-year common on the metric is a a lot stronger 5.71%.

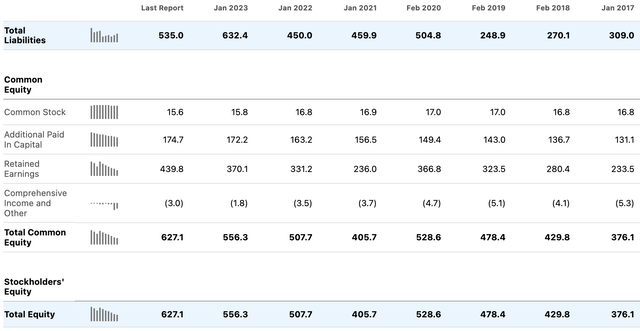

The steadiness sheet in the mean time can also be okay, with extra complete fairness than complete liabilities at an equity-to-asset ratio of 54%:

Searching for Alpha

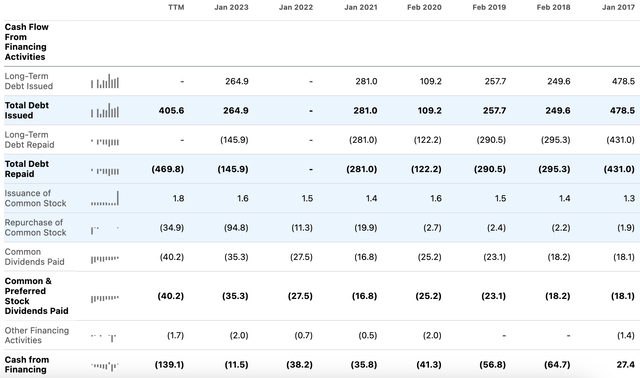

Nevertheless, over the previous three years, the corporate has reported a adverse web change in money. That is largely pushed by excessive capex, complete debt repaid, and repurchase of frequent inventory over the interval. It is necessary to notice that the agency has additionally been issuing a big quantity of debt over the previous two years, though it has not issued almost as a lot frequent inventory because it has repurchased.

Searching for Alpha

Searching for Alpha

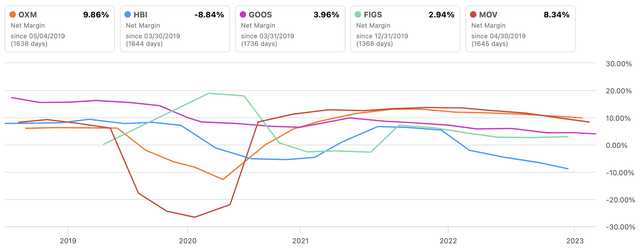

Let’s evaluate Oxford Industries to its main friends to gauge its profitability. Movado Group (MOV) falls slightly below OXM on web margin, with Canada Goose (GOOS) resting at a extra frequent degree for the trade:

Searching for Alpha

Progress Prospects & Additional Market Tendencies

Oxford Industries appears to have very sturdy earlier development, however I’m notably desirous about what the potential bottom-line development for OXM may very well be over the following decade.

Searching for Alpha

Contemplating 16.05% diluted EPS development as an annual common over the past 10 years, I feel 10% development is extra doubtless contemplating the consensus understanding of a slowdown in development for luxurious attire within the close to future. As most of OXM’s income comes from the US, I’m additionally contemplating the slowdown in middle-and-upper class development over the following decade within the nation.

61% of adults in 1971 lived in middle-income households within the US, in comparison with 51% in 2019, in keeping with a report from Pew Analysis Heart. Nevertheless, there was a average enhance from 14% to twenty% of adults within the upper-income tier. This alerts a much less important market over time for OXM, as it’s tailor-made primarily to middle-class prospects from my evaluation. This is a matter I predict might proceed to exacerbate as members of the center class both shift into the decrease or higher bands.

Nevertheless, development within the upper-middle class, as elucidated by the American Enterprise Institute, might imply that OXM merely might want to shift its goal market as time progresses. As a know-how investor, I additionally predict that the excessive adoption of autonomics in economies worldwide will additional exacerbate earnings inequality within the short-to-medium time period in favor of the higher courses till appropriate social constructions are in place. If individuals are incomes extra, OXM can shift its viewers, worth factors, and high quality towards its new, extra prosperous audience and, as such, might preserve 10% or so diluted EPS development per yr over the following 10 years. This permits for a conservative understanding that the enterprise has been round for fairly a while however nonetheless has room to focus on prosperous markets to come back.

Right here is a few indication that the corporate could also be prepared to alter and will concentrate on the minor shift in its goal market that may very well be helpful for them:

We consider that by producing an emotional reference to our goal shopper, life-style manufacturers can command increased worth factors at retail, leading to increased income. We additionally consider a profitable life-style model can present alternatives for branded retail operations in addition to licensing ventures in product classes past our core attire enterprise. – SEC 10-Ok 2007

Moreover, the attire retail market is evolving because of shifting procuring patterns and technological advances, with e-commerce taking part in an more and more necessary function and bricks and mortar retail shops taking part in a unique function in shoppers’ journey to their final buy. The trade can also be being impacted by the approaching of age of the millennial technology whose values and method to {the marketplace} are so completely different from previous generations. We consider that our life-style manufacturers are ideally suited to succeed and thrive within the long-term whereas managing the assorted challenges going through our trade. – SEC 10-Ok 2016

Different dangers, a lot of that are past our means to regulate or predict, might negatively affect our enterprise and monetary efficiency, together with adjustments in social, political, labor, well being and financial circumstances. – SEC 10-Ok 2023

Whereas I’ve not been capable of find an actual point out of the corporate going through danger from class shifts, it’s implied of their writing that important operational variations are going to must happen to stay aggressive and maintain development. Whether or not my analyzed technique is chosen or the agency strikes ahead with different techniques, the agile nature of their enterprise is paramount to continued excessive outcomes. The corporate is evidently conscious of this.

Valuation

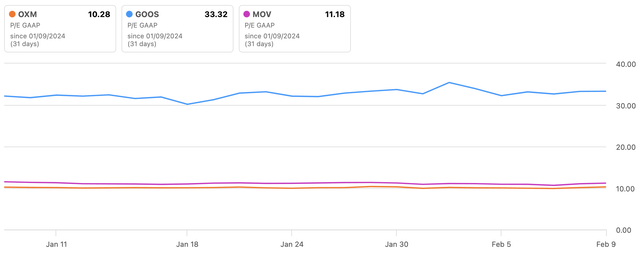

Oxford Industries has a superb valuation in the mean time, with a ahead P/E GAAP ratio of 10.52, which is 37.69% decrease than the sector median of 16.88. After we evaluate OXM to GOOS and MOV, it has the bottom valuation of the three based mostly on current P/E GAAP ratios.

Writer, Utilizing Searching for Alpha

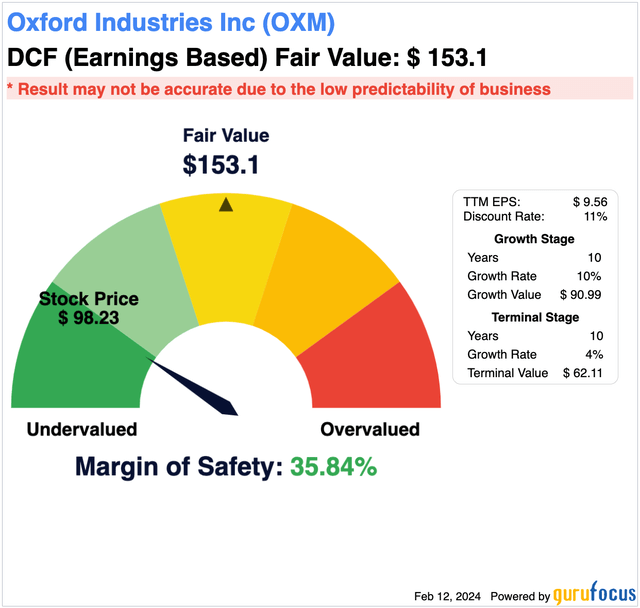

For my discounted money circulation evaluation, I used my discussed-above 10% diluted EPS development charge per yr for the following 10 years, a 4% terminal-stage development charge, and an 11% low cost charge. This means a good worth of round $153.10, a 35.84% margin of security on a inventory worth of $98.23 on the time of this writing:

Writer, Utilizing GuruFocus

Dangers

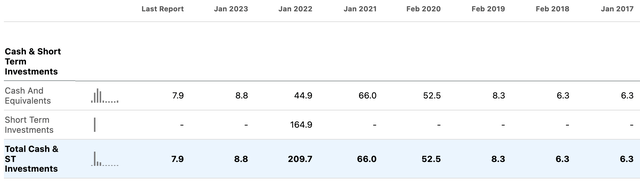

The best danger I’m presenting presently for an funding in OXM is its low liquidity, made clear by my money circulation assertion dialogue above, but additionally by its low degree of money and short-term investments presently on the steadiness sheet. This might negatively have an effect on the group if it experiences any results of macroeconomic recessions and means the corporate might use extra inner effectivity to drive free money circulation and cautious administration of financing to enhance its web change in money transferring ahead.

Searching for Alpha

Moreover, its diluted EPS might not develop at 10% per yr if it fails to regulate its goal market in step with the final financial traits outlined above. This takes shrewd administration, and whereas I’m assured within the enterprise, it nonetheless stays a danger and can take cautious monitoring of pricing and advertising to see proof of continued development.

Conclusion

My analyst ranking for OXM inventory presently is a Purchase. Whereas the steadiness sheet and money circulation statements may very well be improved, and there are dangers associated to long-term development because of market shifts, the funding seems to be usually compelling. It has a big margin of security based mostly on my DCF calculation and diversification amongst manufacturers to offer safety from particular firm points.

[ad_2]

Source link